Pictured: MARK SCHROEDER, German American Bank chairman and CEO

By Steve Kaufman | Photos by John Sodrel

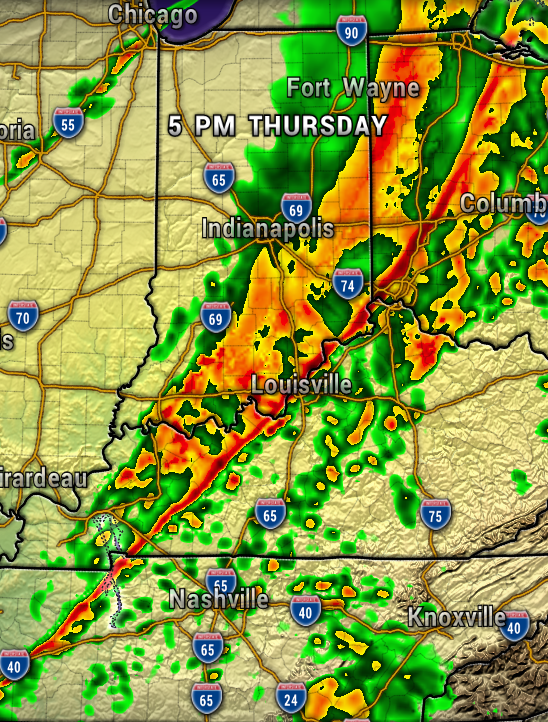

IN MARCH, GERMAN AMERICAN BANCORP, HEADQUARTERED IN JASPER, IND., COMPLETED THE ACQUISITION OF RIVER VALLEY FINANCIAL, A BANKING ORGANIZATION WITH FIVE BRANCHES AND $500 MILLION IN ASSETS, BASED IN MADISON, IND.

In March, German American Bancorp, headquartered in Jasper, Ind., completed the acquisition of River Valley Financial, a banking organization with fifteen branches and $500 million in assets, based in Madison, Ind.

German American now has 51 offices in 20 counties, more than 600 employees and about $2.9 billion in assets. It comprises 16 separate community-banking institutions that have joined forces over the last 25 years.

Its market area has spread across Eastern and Western Indiana, and from the Ohio River north to Columbus, Ind. According to chairman and CEO Mark Schroeder, it is the sixth-largest Indiana-domiciled bank.

That’s quite a bit of growth for the 106-year-old Dubois County banking organization that began its expansion program in the early 1990s, when a change in Indiana law allowed banks to expand beyond their initial county charters. At the time, German American had six locations and was a thriving but still very local operation.

“We had developed a strong, well-known brand in Dubois County,” Schroeder recalls, “but as we grew, we were concerned that the German American name wouldn’t be as well-known in other markets.”

It’s a branding challenge that confronts companies in all industries. In the world of community banking, though, it was especially challenging because, as Schroeder says, “everything for us revolves around having local identity and expertise, knowing and understanding our individual communities, clients and markets. It’s a trust-and-comfort thing.”

It’s a branding challenge that confronts companies in all industries. In the world of community banking, though, it was especially challenging because, as Schroeder says, “everything for us revolves around having local identity and expertise, knowing and understanding our individual communities, clients and markets. It’s a trust-and-comfort thing.”

German American’s initial approach was signage on each of the branches that kept the original bank’s name but added, in smaller letters, “a member of German American Bancorp.”

However, all the banks shared common products and operations through a single computerized system. That led to unwanted confusion among customers. “Too often, people didn’t realize that they could make deposits or use the ATMs at any of our member branches,” says Schroeder.

By about 2008, says Schroeder, the company knew it needed a common brand from a pure marketing perspective, to build name recognition. “You have to build a single brand that stands for something,” says the CEO. “You can’t build five or six different brands.”

As the German American brand spread, so did its reputation for solid and dependable financial management. Interestingly, says Schroeder, the name helped, playing off the German characteristic of a sensible, conservative approach to monetary policy – especially among the large German ancestry and heritage along the Ohio River Valley.

The German characteristics for discipline and solidity helped again in 2009, when the world’s economy seemed to be falling apart. “We have always had a disciplined credit culture,” says Schroeder, who has been with the bank since 1972, before becoming president in 1991 and CEO in 1999. “We subscribe to the belief that we’re doing our clients a disservice if we approve loans they don’t have the wherewithal to repay.”

Schroeder admits that did leave a lot of money on the table, especially the bank’s refusal to make sub-prime mortgages and sell some of those into the secondary market, a practice that was helping other lenders thrive.

“We looked at it and walked away,” says Schroeder. “I was beginning to think I was the Bobby Knight of community banking, that maybe the game had passed me by. But, we pride ourselves on our knowledge of and service to the local community. That’s what community banks are supposed to do. We knew our clients well, knew the people behind the credit applications, knew those who had the ability to pay and those who’d be hurt if they got in over their heads.”

As a result, German American rode the mortgage bubble and ensuing recession without much adverse effect. It also helped that the local manufacturing community, often referred to as “the wood office furniture capital of the world,” remained pretty solid. During those years, says Schroeder, Dubois County always had one of the two lowest rates of unemployment in the state. (Hamilton County, north of Indianapolis, was the other.)

“One of the reasons we excelled is because we did have that knowledge of our client base,” says Schroeder. “In community banking, you don’t cut and run when things are tough.”

Another secret to German American’s success was the expansion of lines of business it has been offering since around the turn of the century. “We started to extensively expand our property and casualty insurance and investment brokerage businesses, starting in 1999,” says Schroeder, “and did the same with our trust operations starting in 2011, and have continued aggressively to build out those lines of business since then.”

It has all led to an enviable growth story. For the last several years, German American did a comparative analysis of all publicly traded banks, from Chase Bank down to the smallest players, slicing it in ever-thinner metrics.

“Any way you slice it, we’re one of the highest-performing banks in the country,” says Schroeder. “We’ve been profitable every year for the last 10; have posted record performances in each of the previous five years; had a record performance in the current year; and our return on shareholder equity has been above the 12- to 13- percent threshold.”

Interestingly, he notes, almost all of the consistently top performers were community banks under $10 billion in assets. There are two other similarly sized banks at the top of every analysis: Stockyards Bank in Louisville and Lake City Bank in Warsaw, Ind.

The secret sauce is not so secret: Know your customer. Know your market.

“Everything for us revolves around having local identity and expertise,” Schroeder says. “We know and understand the community, the market, our clients. We operate in markets which tend not to be as boom-and-bust as are other areas of the country. When other communities’ real estate values soared in the boom years before 2008, the values in our markets remained fairly steady. And when the values plunged in those other communities, our values continued to remain steady.”

Now that things are improving, Schroeder says German American’s demand for credit has exceeded even the pre-crash heights.

“Our commercial customers have a steady client base,” he notes. “This area was not killed by the energy crisis, we don’t have a lot of oil-based or coal-related businesses.

“Realtors tell us there’s not enough a supply of homes to meet the demands in certain price ranges, so we’re doing a lot of financing for housing developers.”

Steady. Smart. Minimizing surprises. And that means profitable.

WHEN “GERMAN” BECAME AN ISSUE

The German American Bank was formed in 1910 in a Southern Indiana community that had been home to German immigrants for about 70 years.

“In the early 1840s, a Croatian, German-speaking priest named Joseph Kundek was assigned to attend to six German-Catholic families who had settled in the area,” relates current chairman and CEO Mark Schroeder, whose family was one of the six. “Eventually, Fr. Kundek went back to Germany – to Pfaffenweiler, a village in the Baden-Freiberg area in the Southwest – and offered residents land if they’d emigrate to the U.S.” About 200 residents took the offer and relocated to Jasper.

They prospered as farmers and woodworkers, and German American bank was created to serve the community. However, during World War II, there was

a huge discussion at the bank’s annual meeting about changing the perhaps-now-unpopular name. Many German-sounding brands faced the same challenge and did change their names during that time, says Schroeder.

“But,” he says, “the president of the bank said ‘We’re not a German bank, we’re a German-American bank.’ So the name survived.”

GERMAN AMERICAN BANCORP

So steady and reliable is German American Bancorp that its headquarters building is on the exact site of its original 1910 bank location in Jasper, Ind. Of course, now it’s a 3½-block campus.

THE MAIN ADDRESS IS: 711 Main Street, Jasper, IN 47546 | 812.482.1314; 800.482.1314 | www.germanamerican.com

The web site provides the addresses, phone numbers and hours of all the other retail branches in Bedford, Bloomington, Columbus, Dubois, Evansville, Ferdinand, Holland, Huntingburg, Ireland, Jasper, Loogootee, Montgomery, Newburgh, Oakland City, Petersburg, Princeton, Rockport, Tell City, Vincennes, Washington and Winslow, Ind. (Plus the new locations, former River Valley branches, that weren’t yet up on the site.)

The site also lists the locations for insurance and investment services.