By Ray Lucas

Each year, every corporation in America is required by law to hold an annual Shareholder meeting. It’s typically a boring affair that requires the shareholders to vote on corporate board members, approve an accounting firm and to hear from executives sharing their annual report and strategic vision for the year ahead.

While most of these corporate meetings are pretty dry, there are a few outliers that offer more animated examples for businesses. Warren Buffet, the billionaire leader of Berkshire Hathaway, hosts one of the most exciting annual gatherings that has been referred to as “Woodstock for capitalists.” Their meetings have included shopping days, a video about the company with celebrity appearances on a jumbotron, a folksy question and answer session with Mr. Buffett, and an “invest in yourself” 5K run. It draws 40,000 shareholders and has grown into an exclusive who’s who of investors.

With Buffet’s example of creativity in mind, I wonder what it would look like if each family were also required to hold an annual shareholder meeting? As I draw on my own family’s example, I can envision our four shareholder children attending while my wife and I, the exhausted but passionate executive leadership team, try to highlight our family successes for the year and address shareholder questions and concerns.

The meeting would start after a quorum is established with a tense vote to see if the shareholders once again approve of the leadership team of Mom and Dad. Mom gets four yes votes to ratify her role for another term. The early vote by those in attendance is two for and one against Dad. With one child away at college, a proxy vote has to be received by mail and puts Dad over the top by a final 3-1 margin. Dad makes a mental note to check with the official meeting secretary on the “no vote” to decide who won’t be getting dessert tonight. The minutes note that both parents are retained as the head of the family.

The meeting would start after a quorum is established with a tense vote to see if the shareholders once again approve of the leadership team of Mom and Dad. Mom gets four yes votes to ratify her role for another term. The early vote by those in attendance is two for and one against Dad. With one child away at college, a proxy vote has to be received by mail and puts Dad over the top by a final 3-1 margin. Dad makes a mental note to check with the official meeting secretary on the “no vote” to decide who won’t be getting dessert tonight. The minutes note that both parents are retained as the head of the family.

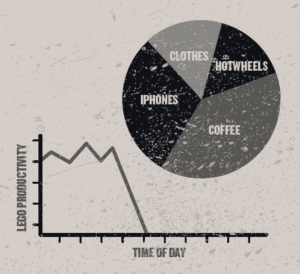

The next order of business is to approve retention of the accounting firm of Money Leaks Out in Every Direction, PLC. Dad makes the point before the vote that if the kids could cut back on shareholder perks like iPhones, trendy clothes and a weekly Hot Wheels purchase during grocery trips to Meijer, the family corporation would have a much improved balance sheet. He recommends a new accounting firm of Tighten Our Belts Inc. for a vote. The college-aged shareholder child in attendance counters that the executive’s twice-a-week habit of six dollar coffees should also be eliminated. Dad withdraws his motion for a new accounting firm while sipping on the Dark Drink Latte just purchased at Coffee Crossing.

At this point, the annual meeting is taken over by an activist seven-year-old shareholder arguing that large sections of corporate policies are unjust. He grabs the mic to plead that early bedtimes are killing nighttime Lego productivity. A twelve-year-old shareholder joins in the fray to complain that executive allowances are 1,000 times larger than the children’s shareholder allowance.

The executives counter with a “we’ll see” promise to review these policies. The inexperienced shareholder’s complaints are turned away for now.

Finally, my wife and I use a Power Point presentation to share our vision for the future of our family: Be kind. Tell the truth. Say your prayers. Love each other. Be joyful. Give thanks. Obey your parents. As we look into their bright, young faces, we can tell we are losing the crowd quickly.

Resorting to a tried and true corporate strategy to calm our investors, we offer a larger dividend. “Lets go get ice cream at Graeter’s!” we announce to the now agreeable shareholders. The enhanced dividend policy is a success.

Is there a motion to adjourn? We receive a slightly unparliamentarily first and second motion both coming from our seven-year-old. The motion carries unanimously.

MY WIFE AND I USE A POWER POINT PRESENTATION TO SHARE OUR VISION FOR THE FUTURE OF OUR FAMILY: BE KIND. TELL THE TRUTH. SAY YOUR PRAYERS. LOVE EACH OTHER. BE JOYFUL. GIVE THANKS. OBEY YOUR PARENTS.

Families, like corporations, are primarily concerned with return on investment and shareholder value. The return may look different for these groups, but the investment principles are similar. As Buffet once quipped at the Berkshire Hathaway gathering when asked about how long investors should hold their stock, “Our favorite holding period is forever.”

As a parent to our four beautiful shareholders, I completely agree with Mr. Buffet that the appropriate way to view our return on investment is measured in terms of forever. Our family corporate minutes are stained with drips of cotton candy ice cream as evidence of that measure. Meeting adjourned.